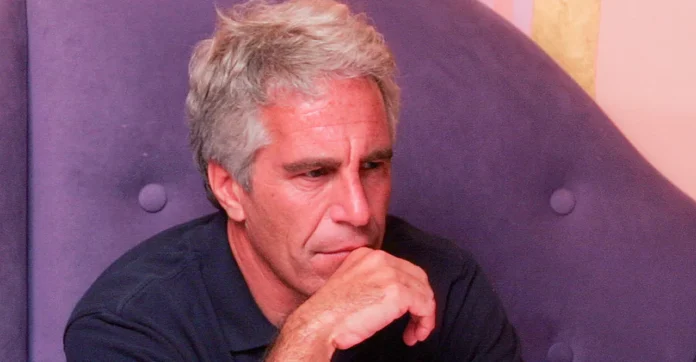

A damning report from The New York Times has revealed that JPMorgan Chase processed over $1 billion for convicted sex offender Jeffrey Epstein across 15 years, maintaining the banking relationship well after multiple compliance red flags were raised by staff. The revelations reinforce longstanding critiques of the financial sector’s ethical lapses and corporate complacency in the face of criminal activity.New York PostThe Times of India

Internal Red Flags Ignored in Pursuit of Profit

- Suspicious Withdrawals Overlooked: Compliance teams flagged Epstein’s unusually high-frequency cash withdrawals—ranging from $40,000 to $80,000 multiple times per month, totaling more than $750,000 in a single year—as early as 2006, raising potent money laundering concerns.New York PostCNNCNBC

- Young Women’s Accounts Set Up at His Request: Despite these warnings, JPMorgan even opened accounts for young women associated with Epstein—some later identified as his trafficking victims—at his direction.New York PostCBS News

- Lax Oversight Even After Conviction: Epstein remained a client until 2013, even after pleading guilty in 2008 to soliciting a minor, a point in the timeline when most institutions would re-evaluate such relationships.New York PostBanking DiveBusiness Insider

Leadership’s Role: Deflecting, Downplaying, and Laughing It Off

- Stephen Cutler’s Warning: Then–General Counsel Stephen Cutler sent a memo in 2011 stating, “This is not an honorable person in any way. He should not be a client.” Yet no decisive action was taken.The Washington Post

- Jes Staley’s Defense: Epstein’s chief internal advocate, Jes Staley (head of private banking), actively pushed to maintain the account—despite concerns—and even reassured colleagues by describing Epstein as “shaken” and claiming his denial of wrongdoing.New York PostThe GuardianWikipedia

- Mary Callahan Erdoes’ Mixed Actions: Erdoes circulated internal statements expressing distress—“so painful to read”—yet she continued to authorize loans to Epstein and jokes persisted. One such comment from Staley joked about the age gap in marriages “fitting well with Jeffrey,” followed by laughter.New York Post

- Passing the Buck: In depositions, JPMorgan CEO Jamie Dimon attributed final authority to Cutler, while Cutler pointed to Staley and Erdoes. Each suggested the others possessed the authority or motivation to terminate Epstein’s accounts.The Washington Post+1

Business Deals and Trafficking Enablers

- Profitable Introductions: Epstein used his influence to refer high-net-worth clients—like Google co-founders—and broker pivotal deals, such as JPMorgan’s acquisition of Highbridge Capital in 2004, which generated significant revenue for the bank.Wall Street On ParadeBanking DiveReddit

- Allegations of Active Facilitation: U.S. Virgin Islands legal filings allege JPMorgan handled over $5 million in cash withdrawals on behalf of Epstein between 2003 and 2013 without filing mandatory Suspicious Activity Reports (SARs). The bank is accused of actively facilitating his sex-trafficking operation.Wall Street On ParadeCBS NewsWikipediaVanity FairReddit

Legal Fallout & Financial Settlements

- In 2023, JPMorgan settled with Epstein’s accusers for $290 million, and separately with the U.S. Virgin Islands for $75 million, acknowledging that retaining Epstein as a client was a mistake—while denying knowledge of his criminal conduct.The GuardianVanity FairNew York PostWikipedia

- Staley Battles Regulators: Jes Staley is currently fighting a fine of around £1.1 million and a prohibition from senior roles imposed by U.K. financial regulators, who concluded he misled them about his closeness to Epstein.The TimesAP NewsWikipedia

What Happened, and Why It Matters

| Concern | Details |

|---|---|

| Culture of Compliance Failure | Persistent red flags were rooted in wealthy patronage and revenue fears over ethical duty. |

| Leadership Accountability Gaps | A chain of deflection and inaction among senior leaders diluted responsibility. |

| Reputational Harm & Legal Risk | The bank paid hundreds of millions in settlements and faces ongoing litigation. |

| Ethical Banking Under Scrutiny | Case underscores urgency for stricter governance, regulatory oversight, and institutional ethics. |

Final Word

The JPMorgan–Epstein saga is not merely a tale of compliance failure—it is a stark reminder of how influential clients and institutional greed can distort ethical standards. Despite repeated alarms, leadership passivity allowed Epstein’s criminal enterprise to flourish—leveraging the bank’s legitimacy and infrastructure. The fallout continues, demanding systemic change in how finance handles red flags and moral responsibility.